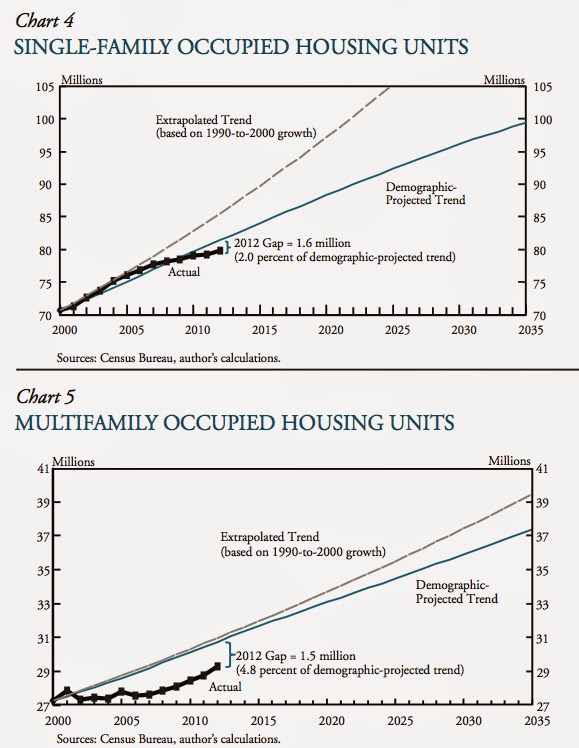

I pulled these two graphs out of a report recently authored by Jordan Rappaport, an economist working for the Kansas City office of the Federal Reserve.

The upper graph looks at growth in single family housing stock. It shows a wide divergence between the growth trend established between 1990 and 2000, and the demographic trend, which indicates the realistic potential demand. This graph proves that the housing bubble, which burst in late 2005, was unsustainable.

The lower graph shows that the bubble (as indicated by divergence of the dashed line and the blue line) was less pronounced for multi-family housing. Not only that, the gap between the number of units available and the projected demand is much larger: 4.8% for multi-family units, compared to 2% for single-family units.

Furthermore, the Fed report shows that the housing collapse was less drastic for multi-family units, and that multi-family construction recovered faster. Why? According to the Fed, a major factor is that Baby Boomers want to downsize, often moving from the suburbs into cities.

The full report is visible here. Two key points are...

- Over the long term, single-family homes are a losing bet. As Rappaport notes, The baseline projections described in this article suggest that construction over the near future will accelerate only moderately for single-family housing but strongly for multifamily housing. Over the intermediate and longer term, even optimistic assumptions project a relatively moderate peak level of single-family construction, which will be followed by a large contraction over many years. Conversely, even pessimistic assumptions project a relatively high peak level of multi- family construction, which will be followed by a decline to a still-high level of construction.

- Cities need to pay attention to the Boomers' desires to downsize and move closer in. For cities, this offers the possibility of revitalization and the shoring up of public finances. But to attract aging suburban households, cities will likely need to offer significant amenities such as safe streets, diverse retail and restaurant options, museums, and venues for theater, music, and sports. Suburbs seeking to retain aging households may need to re-create a range of these urban amenities and enact some rezoning to encourage multifamily construction.