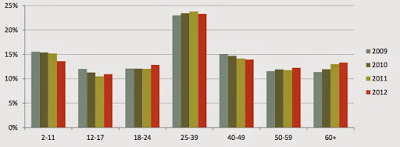

The cable TV network A&E just cancelled it's top-rated show, Longmire, even though it draws a bigger audience than Mad Men. Why? In a nutshell, because Longmire's viewers are, on average 60—that's about twelve years older than the A&E's overall audience.

According to Deadline Hollywood,..

In its second season, the series, based on Craig Johnson’s mystery novels, averaged nearly 6 million viewers, up 9% from Season 1. Longmire‘s viewership has dipped only slightly in Season 3 to 5.6 million viewers (in most current ratings, up from the previous 4.6 million season average), despite its lead-in, Criminal Minds repeats, being a lot weaker (-72%) than the series’ lead-in last year, original drama The Glades. The cancellation of that series got a strong reaction from fans; the axing ofLongmire, which has a wide fan base, will likely not go well with them either.

Devoted Longmire fans will be doubly pissed when they realize that Season 3 ends with a cliffhanger, and triply pissed when the truth sinks in on them. A&E's decision to cancel was influenced by the fact that Warner Brothers, not A&E produces the series; but the main reason was, simply that the viewership was too old.

Advertisers still can't wrap their heads around a 60 year-old audience, so a 30-second spot on Longmire sells for about half what a Mad Men spot commands, even though as one disgruntled Longmire fan noted, "They are still suffering under the delusion that those in their 20-30’s have the money. What 20-30 years-olds have is a room in mommy & daddy’s house due to unemployment. A&E are pissing off the people that do have disposable income."

That's a little oversimplified, considering that Mad Men's audience is also famously upscale. According to AMC, half of the 40- and 50-somethings watching the ad drama earn $100+. But, no matter how you cut it, there's a big disconnect between A&E, advertisers, and Longmire's solid older audience. Considering the high margins in pickup trucks and SUVs, and the fact that the 55-64 cohort are major buyers of new cars, I'm surprised there wasn't a car company willing to put together a coordinated product-placement/advertising/social campaign built around the show.